For Chip Makers, Government Involvement Won’t Come Free

Chip-making giants and their investors understandably like the idea of the U.S. government pitching in on a very expensive business. They should be careful what they wish for, though, as recent history has shown that growing political involvement in the sector hasn’t been cost-free.

Shares of Intel and Taiwan Semiconductor Manufacturing, TSM 1.15% or TSMC, both got a lift Monday after a report over the weekend from The Wall Street Journal that the Trump administration is in talks with both companies about building more chip-fabrication facilities in the U.S. No specific proposals were outlined, though apparently Intel pitched an idea to the Defense Department of building a commercial foundry in partnership with the Pentagon.

TSMC builds most of its advanced chips in its home country of Taiwan, though the article noted that the company is also considering new facilities in the U.S., partially at the behest of Apple —its largest customer. The company’s Taiwan-listed shares rose 1.2% in Monday’s trading. Intel’s U.S.-listed shares closed up a little less than 1%.

The coronavirus pandemic and U.S.-China trade war before that laid bare the vulnerability many American companies have in relying on key components that are often made offshore. That has turned the semiconductor industry into a political football between the two world powers. The degree of sensitivity became evident even before the crisis, when the Trump administration nixed Broadcom’s proposed takeover of Qualcomm in early 2018 and when the Chinese government effectively killed Qualcomm’s proposed buyout of NXP three months later.Among the latest developments are an effort to enact export controls over advanced chip-making equipment—a market dominated by U.S. companies such as Applied Materials, KLA and Lam Research. The Commerce Department announced new rules two weeks ago that could add more restrictions to the sale of such gear to the Chinese market, which UBS has projected to account for about 17% of the industry’s total sales this year. The true impact of those new rules still isn’t clear, though Lam Research added a risk factor to its 10-K filing the same week, saying that the new rules could “materially and adversely” affect its business.

Intel is trying to see the bright side of this rising and geopolitically driven tension for the moment, enthusiastically courting government support for building facilities. This is understandable given the growing cost Intel and TSMC are bearing in their race to stay on top of the chip-making pile. Both companies have watched their annual capital expenditures grow an average of 12% annually over the past five years, and both are still expected to spend about $15 billion or more this year even despite the broad global economic downturn now under way.

Some help from the government could help Intel and TSMC manage those bills. But it would likely come with many constraints—including to whom they could sell. Investors should keep in mind that public dollars generally come with strings attached.

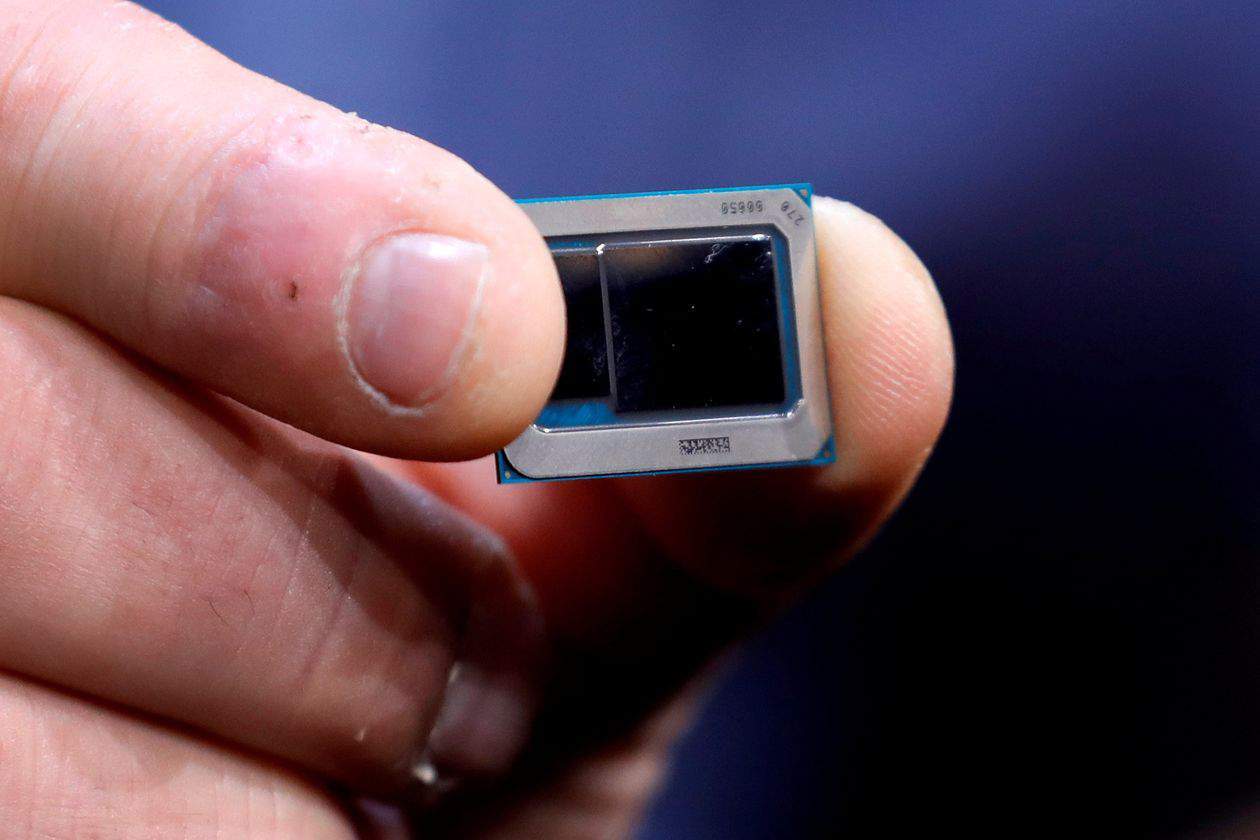

Photo: Intel is courting government support for building chip-fabrication facilities. - STEVE MARCUS/REUTERS